Concordia completes acquisition of Swala Resources and provides exploration update on activities in Burkina Faso Concordia Resource Corp. (TSX-V: CCN) ("Concordia" or the "Company") is pleased to announce that effective January 13, 2012, following the approval of the shareholders (the "Swala Shareholders") of Swala Resources Inc. ("Swala") at a shareholders' meeting held on December 23, 2011, it has completed its acquisition of all of the issued and outstanding securities of Swala pursuant to a court approved plan of arrangement involving Concordia, Swala and the Swala Shareholders, optionholders and warrantholders of Swala (the "Arrangement"). Swala brings to Concordia an extensive exploration portfolio in the highly prospective regions of Burkina Faso, Gabon, the Democratic Republic of Congo, Zimbabwe and Mozambique with a land package totaling over 12,400 km2, as well as an experienced management team and directors with extensive expertise in Africa.The Acquisition Pursuant to the terms of the Arrangement, each Swala Shareholder will receive 1.9 common shares of Concordia for each share of Swala held. Prior to closing, Swala had 13,555,641 shares issued and outstanding, which will result in approximately 25,755,718 shares of Concordia being issued to Swala Shareholders (subject to adjustment for fractional shares). Holders of warrants of Swala ("Warrantholders") who have not exercised warrants of Swala ("Warrants") prior to the closing of the Arrangement (the "Closing") will have their Warrants converted into common share purchase warrants of Concordia ("Concordia Exchange Warrants") in accordance with a warrant exchange ratio of 0.5 Concordia Exchange Warrants for each Warrant held. Warrantholders who currently hold Warrants having an exercise price of $2.50 will receive Concordia Exchange Warrants with an exercise price of $0.88. Warrantholders who currently hold Warrants having an exercise price of $1.75 will receive Concordia Exchange Warrants with an exercise price of $0.61. Concordia will issue: (i) 502,222 Concordia Exchange Warrants with an exercise price of $0.88, expiring on December 9, 2012; (ii) 1,200 Concordia Exchange Warrants with an exercise price of $0.61, expiring on December 9, 2012; (iii)45,936 Concordia Exchange Warrants with an exercise price of $0.88, expiring on December 20, 2012; (iv) 285,714 Concordia Exchange Warrants with an exercise price of $0.88, expiring on December 22, 2012; (v) 605,830 Concordia Exchange Warrants with an exercise price of $0.88, expiring on December 31, 2012; (vi) 51,500 Concordia Exchange Warrants with an exercise price of $0.61, expiring on December 31, 2012; and (vii) 11,429 Concordia Exchange Warrants with an exercise price of $0.88, expiring on August 31, 2013. Any outstanding Swala options were exercised for Swala shares immediately before the Closing on a cashless, in-the-money value basis, using the 1:1.9 share exchange ratio and unexercised options will be cancelled. Following Closing, Concordia will issue options to acquire an aggregate of 2,221,754 shares of Concordia, with an exercise price of $0.70 per share, to members of the Swala team. The combined company will retain the Concordia name and remain headquartered in Vancouver, Canada. Swala will become a wholly owned subsidiary of Concordia and the Swala Shareholders will be shareholders of Concordia, holding approximately 30% of the issued and outstanding shares of Concordia post-Closing. "The acquisition of Swala provides Concordia with the ability to commence an aggressive drill programme in Burkina Faso, where Swala owns 100% of the Kerboulé property (containing the Araé and Gassel Manéré licenses) and is earning up to an 80% joint venture interest on SearchGold Resources Inc's (TSX-V: RSG) Guéguéré property," stated Edward Flood, CEO of Concordia. "The focus of the proposed drilling programme for 2012 is to generate a NI 43-101 qualified resource in the Kerboulé area of the Arae Gassel licenses while continuing to explore for new targets on the Arae-Gassel and Guéguéré licenses. We believe that Swala's African properties, and its Burkina Faso properties in particular, have all the components necessary to establish a very promising future in one of the great gold plays of West Africa. Members of Swala's technical team are former Anglo American plc. and De Beers executives with extensive operational experience throughout the African continent. This made Swala an attractive acquisition opportunity and we are pleased to have closed this transaction." Commenting on behalf of Swala, Gerard de la Vallée Poussin, Executive Chairman of Swala stated, "In challenging markets we are fortunate to have found a suitor in Concordia who shares our enthusiasm for Africa and a belief in our projects and team. Together we have all of the elements of a successful exploration company and this transaction allows the potential of our various projects in Africa to be realized and in particular the Kerboulé gold project in Burkina Faso." Exploration Update Concordia is pleased to provide the following exploration update in respect of Swala's activities in Burkina Faso: A 2011 work program for the Kerboulé property was recommended by SRK Consulting (Canada) Inc. in its Independent Technical Report dated 28 July 2011. The objective of the program was to complete the acquisition of reconnaissance exploration work over the entire property to identify new gold mineralization targets in largely unexplored parts of the licences, to undertake 'step-out' RAB drilling to investigate possible extensions to some of the known mineralized areas and prepare exploration targets for RC and core drilling planned for 2012. Since that report was published, the following work has been completed on the Kerboulé property:

1. Geophysical Survey A high resolution airborne magnetic survey was completed by Xcalibur Airborne Geophysics of South Africa in February 2011. The geophysical data was interpreted by Dr. IJ Basson of Tect Geological Consulting ("Tect"), South Africa and, having confirmed targets generated in previous exploration, is being used to assist exploration and drilling targeting planned for 2012. Tect's conclusions on the geophysical data were as follows:

A total of 14 trenches (3.8 linear km) were excavated across the gold mineralization area for structural interpretation and detailed sampling. A total of 3,743 trench samples have been collected, of which, to date, assay results have only been received for 1491. The samples are being treated and analyzed by Biggs Global laboratory in Ouagadougou, Burkina Faso, using the bottle roll, DIBK extract, flame-AAS technique. Complete results from that work will be disclosed once all assay results have been received, validated and interpreted. The following table provides a summary of the significant results received to date. The Company has not completed a QA/QC analysis on these results and the reader should be cautioned that these results are very preliminary and are not necessarily conclusive.

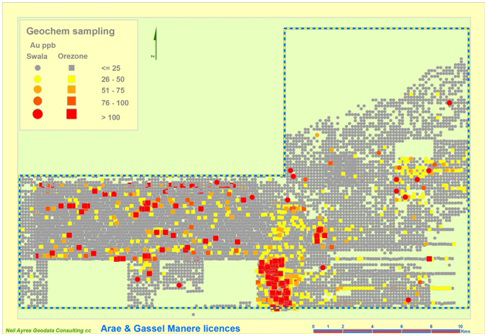

Buttner was contracted by Swala to carry out a structural analysis of the Kerboule area and his findings were also integrated into the geophysical interpretation undertaken by Tect (discussed above). The figure below shows the two main structural trends in the Kerboule area. 3. Regional geochemical 'pit' sampling A geochemical 'pit' sampling programme was undertaken to complete the coverage of soil samples initially collected by Orezone Gold Corporation ("Orezone") (TSX: ORE), the previous project operator. The sampling programme was undertaken during the dry season, ending in September 2011. A total of 4,054 samples were collected during this programme. Sample results are now available, and a number of new anomalies have been identified. Sixteen samples returned values greater than 100 parts per billion ("ppb") Au with the highest value at 679 ppb. The most interesting "continuous" gold anomaly is in eastern Gassel Manéré, where five samples had values greater than 100 ppb Au with a maximum of 580 ppb Au. The soil geochemical surveys and the anomalies identified are shown on the map, below. Below is a compilation map showing the distribution of Orezone's historical geochemical samples (squares) and recent pit geochemical samples collected by Swala (coloured dots).

4. RAB scout drilling program "Step out" RAB scout drilling was completed to re-evaluate four anomalous areas identified from previous soil sampling. The program consisted of the following:

The following table provides a summary of the significant results received to date. The Company has not completed a QA/QC analysis on these results and the reader should be cautioned that these results are very preliminary and are not necessarily conclusive. The widths quoted in the table below are not true widths.

In addition to the work program outlined above, Swala has initiated an aggressive follow-up exploration program for 2012 on new targets identified by the regional geochemical pit sampling program and the Kerboulé mineralized zone identified by previous Orezone and Swala work and documented in the NI 43-101 report. This includes the following:

Mr. Barry Bayly, is a member of the South African Council for National Scientific Professionals (SACNSP), South Africa and is a qualified person in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"). He is responsible for the exploration program in the Area and Gassel-Manere licences. He has verified the regional geochemical 'pit' sampling results and other data disclosed in this news release. The airborne geophysical survey and structural analysis were contracted to registered professional scientists and the geochemical sampling and trenching program were supervised on site by experienced Swala geologists. In-house quality controls included written procedures and routine checking and verification by senior Swala technical staff. The geochemical "pit" samples were submitted to the Abilab Afrique del'Ouest SARL ("Abilab") in Ouagadougou, Burkina Faso for preparation and assaying using the bottle-roll 'leachwell' flame-AAS technique. Abilab is part of the ALS Laboratory Group and operates under a global quality management system that is accredited ISO9001:2000. Mr. Bayly is the chief operating officer of Swala and is therefore not independent within the meaning of NI 43 101. ABOUT CONCORDIA Concordia Resource Corp. is a well-financed junior exploration company. The successful acquisition of Swala will add to Concordia's precious metals portfolio, which includes the past-producing La Providencia silver mine in Argentina, and will position the company as an African explorer with an emphasis on developing gold deposits holding the potential of one million ounces upwards. Concordia has its head office and executive management team in Vancouver, Canada; its technical team is based in Reno, Nevada. On behalf of the Board of Concordia Resource Corp. "R. Edward Flood" R. Edward Flood, Chairman CONTACT INFORMATION: Concordia Resource Corp. Karl Cahill, VP, Investor Relations Telephone: +1-604-331-981; 1-858-531-6100 Email: info@concordiaresourcecorp.com Website: www.concordiaresourcecorp.com Forward Looking Statements Certain of the statements made and information contained herein is "forward-looking information" within the meaning of the Securities Act (Ontario), including the receipt of necessary permits to conduct exploration and construction, timing of anticipated exploration programmes, the number of holes and metres to be drilled and future plans of the Company. Forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, risks and uncertainties relating to risks inherent in mining, including, without limitation, environmental hazards, industrial accidents, unusual or unexpected geological formations, ground control problems and flooding; risks associated with the estimation of mineral resources and reserves and the geology, grade and continuity of mineral deposits; the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; the potential for and effects of labour disputes or other unanticipated difficulties with or shortages of labour or interruptions in production; actual ore mined varying from estimates of grade, tonnage, dilution and metallurgical and other characteristics; the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations; uncertain political and economic environments; changes in laws or policies, delays or the inability to obtain necessary governmental permits; and other risks and uncertainties, including those described in the Company's management discussion and analysis. In addition, forward-looking information is based on various assumptions including, without limitation, the expectations and beliefs of management, the assumed long term price of metals; appropriate equipment and sufficient labour and that the political environment where the Company operates will continue to support the development and operation of mining projects. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking information. Accordingly, readers are advised not to place undue reliance on forward-looking information. The forward-looking statements contained in this press release are made as of the date of this press release and the Company undertakes no obligation to update publicly or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by applicable law. The TSX-V has neither approved nor disapproved the contents of this press release. Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this press release. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

You can return to the main News Releases page, or press the Back button on your browser. |